It is pertinent to mention here that the CBDT had notified the amendments in the income tax return (ITR) forms for the Assessment Year 2022-23 vide Notification No. Online filing of these ITRs shall be enabled shortly. Taxpayers can download the ITR Offline Utility through the “Downloads” Menu option, and fill and file the ITR through the same.

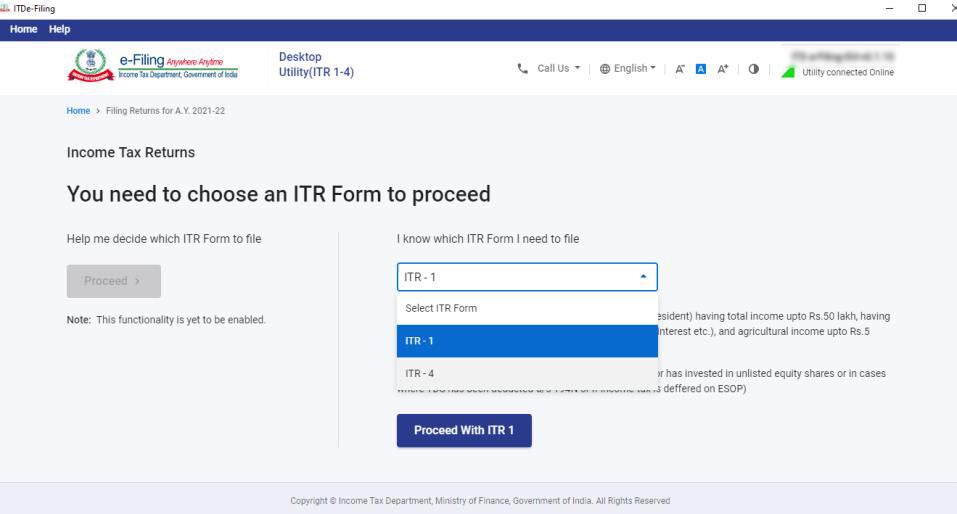

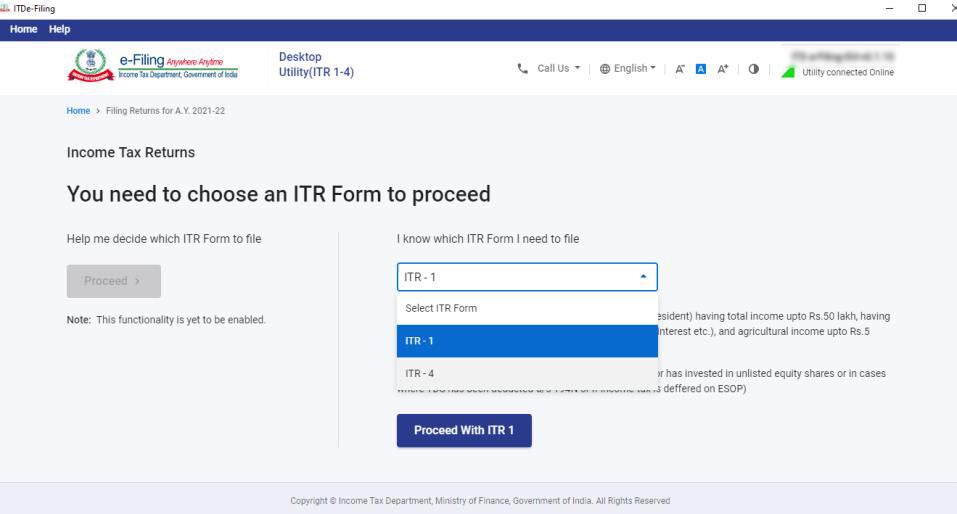

Java Utilities : Microsoft Windows 7/8/10, Linux and Mac OS 10.x with JRE (Java Runtime Environment) Version 8 with latest updates.The Central Board of Direct Taxes ( CBDT ) has released the Common Offline Utility for filing ITR-1 and ITR-4 for Assessment Year 2022-23. Excel Utilities: Macro enabled MS-Office Excel version 2007/2010/2013 on Microsoft Windows 7 / 8 /10 with. The folder will be extracted in the same location where the compressed utility was downloaded. Extract (un-compress) the zip file containing the utilities. The utility has ben updated for calculations of 234B, 234C, 234A and as per the notification 35/2020ģ. (Not for an Individual who is either Director in a company or has invested in Unlisted Equity Shares) The utility has ben updated for calculations of 234B, 234C, 234A and as per the notification 35/2020.įor Individuals, HUFs and Firms (other than LLP) being a Resident having Total Income upto Rs.50 lakhs and having income from Business and Profession which is computed under sections 44AD, 44ADA or 44AE

ITR 7 to be available shortly ITR offline utilities for AY 2020-21 available for e-Filing Utilities updated for calculations of 234B, 234C, 234A and as per the notification 35/2020 Formįor Individuals being a Resident (other than Not Ordinarily Resident) having Total Income upto Rs.50 lakhs, having Income from Salaries, One House Property, Other Sources (Interest etc.), and Agricultural Income upto Rs.5 thousand(Not for an Individual who is either Director in a company or has invested in Unlisted Equity Shares)

ITR 1 2 3 4 5 & 7 offline excel and java utilities for AY 2020-21 available for e-Filing.

0 kommentar(er)

0 kommentar(er)